The rising adoption of biometric solutions, based on digital signature, in the banking, financial services, and insurance (BFSI) sector in the U.S. is one of the major factors propelling the demand for digital signature in the country. The biometric systems utilize secured and advanced digitally sound methods for identification and authentication procedures. These systems provide unique keys to the characters of a person’s signature. The pattern of the signature cannot be stolen or impersonated, thereby eliminating the chances of signature theft and enhancing security.

The burgeoning adoption of internet-based transactions is another important factor fuelling the demand for digital signatures in the U.S. Owing to the shorter time periods offered by online transactions, they are being increasingly adopted by various financial services companies as well as customers in the nation. In addition to this, digital signatures and e-signatures offer numerous advantages, such as enhanced data analysis opportunities, higher employee productivity, increased data security, improved efficiency in record keeping, and higher information benefits to citizens, which make them highly-sought- after in the U.S.

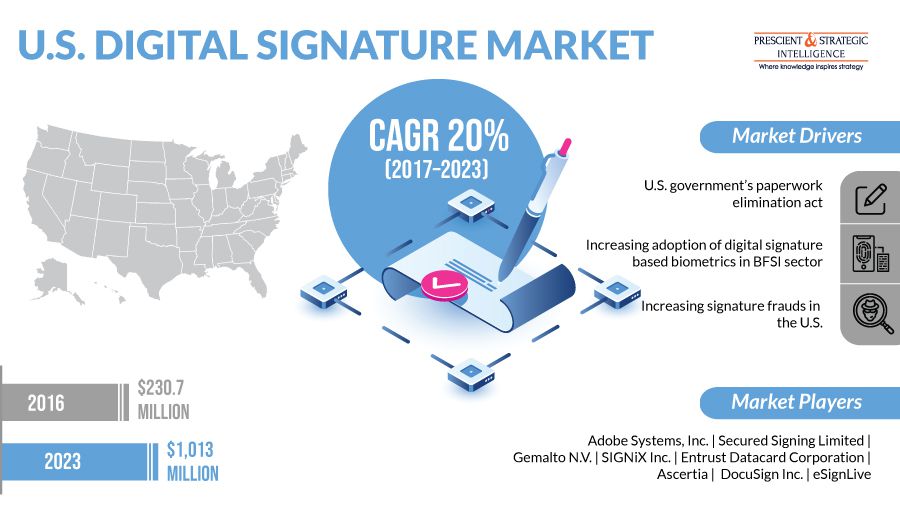

Driven by the above-mentioned factors, the U.S. digital signature market is expected to demonstrate huge growth in the coming years. Since the last few years, the popularity of digital signatures has been increasing rapidly in several industries, on account of the fact that this technology reduces the possibility of thefts and frauds. For instance, various specialists in the healthcare industry, such as lab investigators, researchers, and doctors, are increasingly transferring prescriptions and other digitally signed data from the hospitals’ servers to that of the pharmacies.

In the U.S., digital signatures are implemented either through cloud or on-premises. Of these, the cloud-based implementation of digital signatures is expected to rise rapidly over the next few years. This is mainly attributed to the fact that a lot of companies are offering digital signature solutions and services in the form of subscription-based models. In addition to this, the increasing popularity of cloud-based services and the rise of the pay-as-you-go models are expected to further propel the cloud-based deployment of this technology in the country, in future.

The boom of the e-commerce industry, owing to the soaring internet penetration and increasing ease of online transactions, is offering tremendous opportunities for the growth of the U.S. digital signature market. The adoption of digital signatures will increase in the U.S., as these are used by the e-commerce companies for providing themselves with confidentiality and integrity and enabling authentication in their business transactions. As per the e-Commerce Foundation, the e-commerce market in the nation was observed to be the second largest in the world in 2015, and the situation hasn’t changed much till now.

Hence, it is clear that due to the increasing prevalence of digital transactions and the numerous data security and confidentiality features provided by the digital signatures, the demand for such solutions will rise rapidly in the U.S. in the years to come.