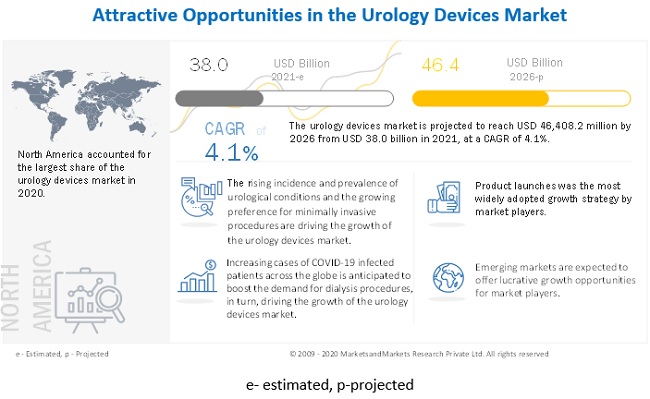

Growth in the urology devices market is mainly driven by factors such as the rising incidence and prevalence of urological conditions, growing preference for minimally invasive procedures, and growing number of hospitals and investments in endoscopy and laparoscopy facilities. On the other hand, factors such as a high degree of market consolidation and the high cost of urology devices are expected to limit market growth to a certain extent in the coming years.

The global Urology devices market is projected to reach USD 46.4 billion by 2026 from USD 38.0 billion in 2021, at a CAGR of 4.1% during the forecast period.

Download PDF Brochure:- https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=173062212

The major players in this market are Fresenius Medical Care AG & Co. KGaA (Germany), Baxter International Inc. (US), Boston Scientific Corporation (US), Becton, Dickinson and Company (US), Olympus Corporation (Japan), B. Braun Melsungen AG (Germany), Stryker Corporation (US), KARL STORZ (Germany), Cook Medical (US), Intuitive Surgical (US), Medtronic plc (Ireland), Cardinal Health (US), Teleflex Incorporated (US), Richard Wolf GmbH (Germany), CompactCath (US), Dornier MedTech (Germany), Nikkiso Co., Ltd. (Japan), Balton Sp. z o.o. (Poland), Dialife SA (Switzerland), Maxer Endoscopy GmbH (Germany), Vimex Sp. z o.o. (Poland), Amsino International, Inc. (US), ROCAMED (Monaco), Well Lead Medical Co., Ltd. (China), Medispec (US), Medical Technologies of Georgia (Georgia), EndoMed Systems GmbH (Germany), Hunter Urology (England), J and M Urinary Catheters LLC (US), and Ribbel International Limited (India).

Fresenius Medical Care AG & Co. KGaA held the leading position in the urology devices market in 2019. The company has maintained its leading position in the market through its strong distribution networks across North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. The company adopts inorganic growth strategies such as acquisitions to increase its dominance in this market. For instance, in February 2019, the company acquired NxStage Medical, Inc. (a US-based home dialysis leader). Similarly, in December 2018, the company acquired 70% shares of Guangzhou KangNiDaiSi Medical Investment Co., Ltd. with the aim of expanding its dialysis care network across China. Such developments have helped the company to significantly expand its product line and thereby enhance its visibility in the urology devices market.

In 2019, Baxter International accounted for the second-largest share of the urology devices market. The company primarily focuses on developing technologically advanced dialysis products and innovative dialysis therapies to strengthen its position in the global urology devices market. The company has a wide geographical presence that spans North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa. The company has strong manufacturing capabilities, a strong sales force, and extensive customer support capabilities. In order to sustain its leading position in the market, the company pursues inorganic growth strategies. For instance, in October 2018, Baxter and the Mayo Clinic collaborated to develop a renal care center of excellence in the US. Additionally, in May 2018, Baxter and the International Society of Nephrology (ISN, US) collaborated to improve access to renal therapy across low and middle-income countries. Such developments have helped the company enhance its visibility in the market.

Request Sample Pages: -https://www.marketsandmarkets.com/requestsampleNew.asp?id=173062212

Olympus Corporation’s leading position in this market can be attributed to its extensive portfolio of endoscopic products and strong sales and distribution network across the globe, which enables it to effectively market its products across the globe. The company has a strong market presence across the globe, which is mainly due to its strong distribution network. The company has a widespread presence across the globe, including the Americas, Africa, Western/Eastern Europe, the Middle East, Asia, and Oceania. Investments are being made to strengthen the company’s geographical presence in emerging countries. The company has also started the 16CSP initiative to strengthen its sales force and marketing functions along with expanding operations in emerging countries. With its strong urology devices product portfolio and wide geographic reach, the company is likely to witness high growth in the urology devices market.