Middle East and Africa Courier Market, By Type (Inbound and Outbound), Delivery Mode (Express Delivery and Normal Delivery), Customer Type (B2B (Business-to-Business), Consumer-to-Consumer (C2C) and B2C (Business-To-Consumer)), Destination (Domestic and International/Cross-Border), End User (Medical Courier, Services (BFSI), Wholesale and Retail Trade (E-Commerce), Primary Industries, Manufacturing, Construction and Utilities), Country (South Africa, Saudi Arabia, U.A.E., Egypt, Israel and Rest of Middle East and Africa) Industry Trends and Forecast to 2028

Market Analysis and Insights: Middle East and Africa Courier Market

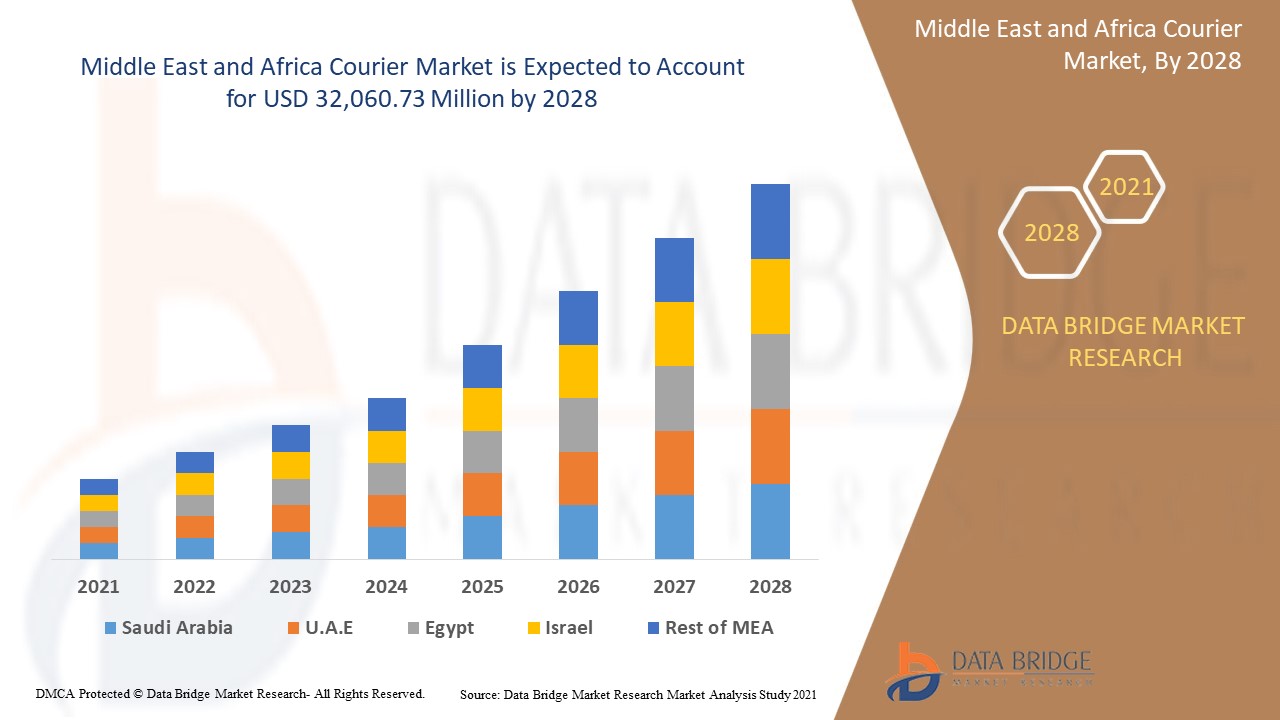

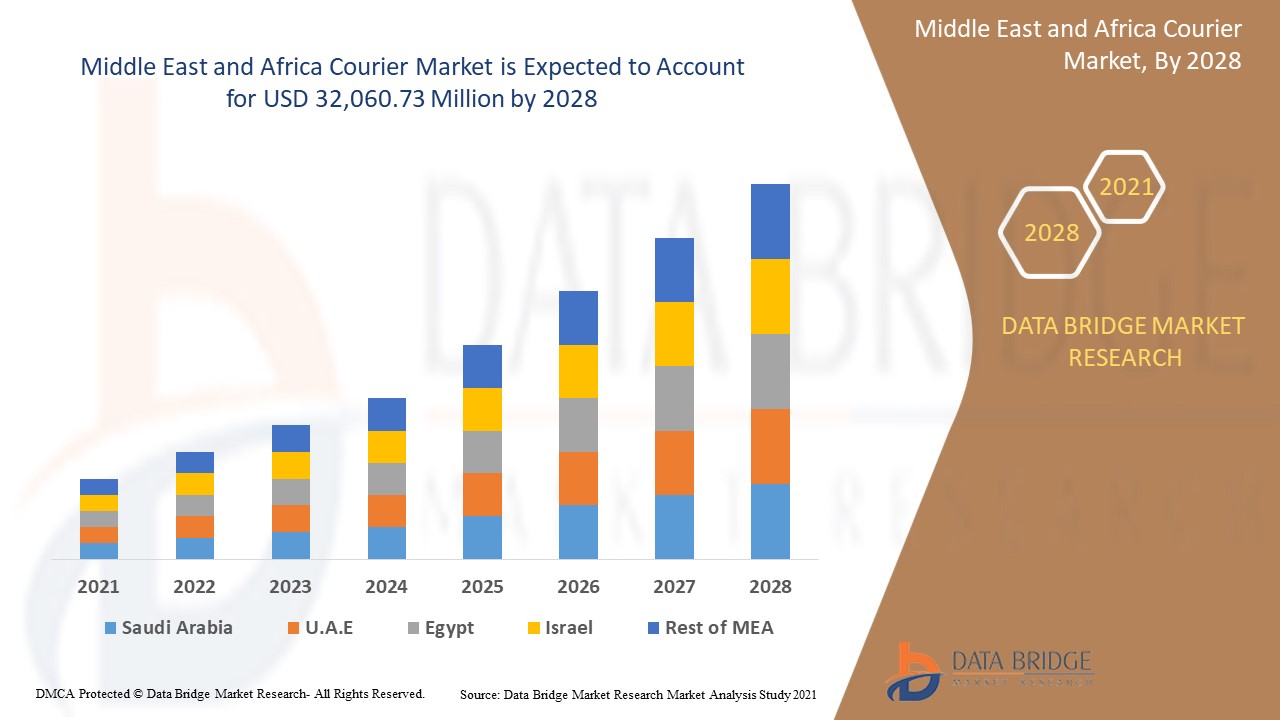

The courier market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.1% in the forecast period of 2021 to 2028 and is expected to reach USD 32,060.73 million by 2028. Increasing adoption of multiple courier services through smartphone devices and internet services across the globe due to the current pandemic situation is expected to drive the growth of the courier market

Courier involves delivering messages, packages and parcels from one person to another by using various modes of transportation. The delivery is made by using multiple modes of transportation such as roadways, waterways and airways. The companies are providing more advanced services such as same-day delivery to enhance customer experience.

Increasing demand for high-end, time-sensitive goods increases the adoption of courier services and is expected to drive the growth of the courier market. Stringent government regulations regarding export and import restricts the export and import activities across the globe and thus restricts the adoption of courier services for export and import activities which is expected to restraint the growth of the courier market. E-commerce is highly supported by the courier services and the increase in online retailing is expected to create new opportunities for the growth of the courier market. Several trade route congestions can delay the shipment of orders and is therefore expected to pose a major challenge for the growth of the courier market.

This courier market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the courier market scenario contact Data Bridge Market Research for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Courier Market Scope and Market Size

The courier market is segmented on the basis of type, delivery mode, customer type, destination and end user. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the courier market has been segmented into outbound and inbound. In 2021, the inbound segment held a larger share in the market attributed to the large volume of shipments transported among the companies, wholesalers and retailers.

- On the basis of delivery mode, the courier market has been segmented into normal delivery and express delivery. In 2021, normal delivery segment held a larger share in the market as customers prefer to have 3-5 days shipping compared to paying more for express shipping.

- On the basis of customer type, the courier market has been segmented into B2B (business-to-business), B2C (business-to-consumer) and consumer-to-consumer (C2C). In 2021, B2B (business to business) segment held the largest share in the market due to high-value goods being delivered in the B2B segment, multiple purchases of products and reduced number of cancelled orders.

- On the basis of destination, the courier market has been segmented into domestic and international/cross-border. In 2021, domestic segment held a larger share in the market attributed to the inexpensive nature of domestic shipments, reduced documentation and regulations involved, ease of convenience and shorter shipping cycle.

- On the basis of end user, the courier market has been segmented into wholesale and retail trade (e-commerce), medical courier, manufacturing, services (BFSI), construction, utilities and primary industries. In 2021, wholesale and retail trade (e-commerce) segment held a larger share in the market owing to the rapid growth of the e-commerce industry, the number of delivery options for customers and real-time tracking of parcels and better customer experience.

Middle East and Africa Courier Market Country Level Analysis

Middle East and Africa courier market is analysed and market size information is provided by the country, type, delivery mode, customer type, destination and end user as referenced above.

The countries covered in the Middle East and Africa courier market report are the South Africa, Saudi Arabia, U.A.E., Egypt, Israel and rest of Middle East and Africa.

Israel dominates in the Middle East and Africa courier market owing to factors such as increasing manufacturing industries and growing import and export activities in the country.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Rising Demand of Courier

The courier market also provides you with detailed market analysis for every country growth in industry with sales, components sales, impact of technological development in courier and changes in regulatory scenarios with their support for the courier market. The data is available for historic period 2010 to 2019.

Competitive Landscape and Courier Market Share Analysis

The courier market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to Middle East and Africa courier market.

The major players covered in the Middle East and Africa courier market report are FedEx, Deutsche Post AG, United Parcel Service of America, Inc., Aramex, DTDC Express Limited, GEODIS among other domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments are also initiated by the companies worldwide which are also accelerating the growth of the courier market.

For instance,

- In October 2020, GEODIS announced the acquisition of PEKAES, a company is engaged in providing transportation and logistics services. The strategic decision is taken to expand the geographical presence of the company in Poland through PEKAES excellent local geographical coverage. The new acquisition increased the customer reach of the company.

Partnership, joint ventures and other strategies enhances the company market share with increased coverage and presence. It also provides the benefit for organisation to improve their offering for courier through expanded range of size.